Design and build a new online claims form for customers involved in motor incidents.

Discovery

-

I carried out call listening with front-line call handlers to understand what types of claims customers registered, how handlers dealt with these claims and how the data was entered into our systems.

I also visited our technology centre and repair garages in Birmingham and worked with engineers to understand what our repair process looked like for customers.

-

I worked with the UX Researcher to conduct interviews and moderated usability sessions.

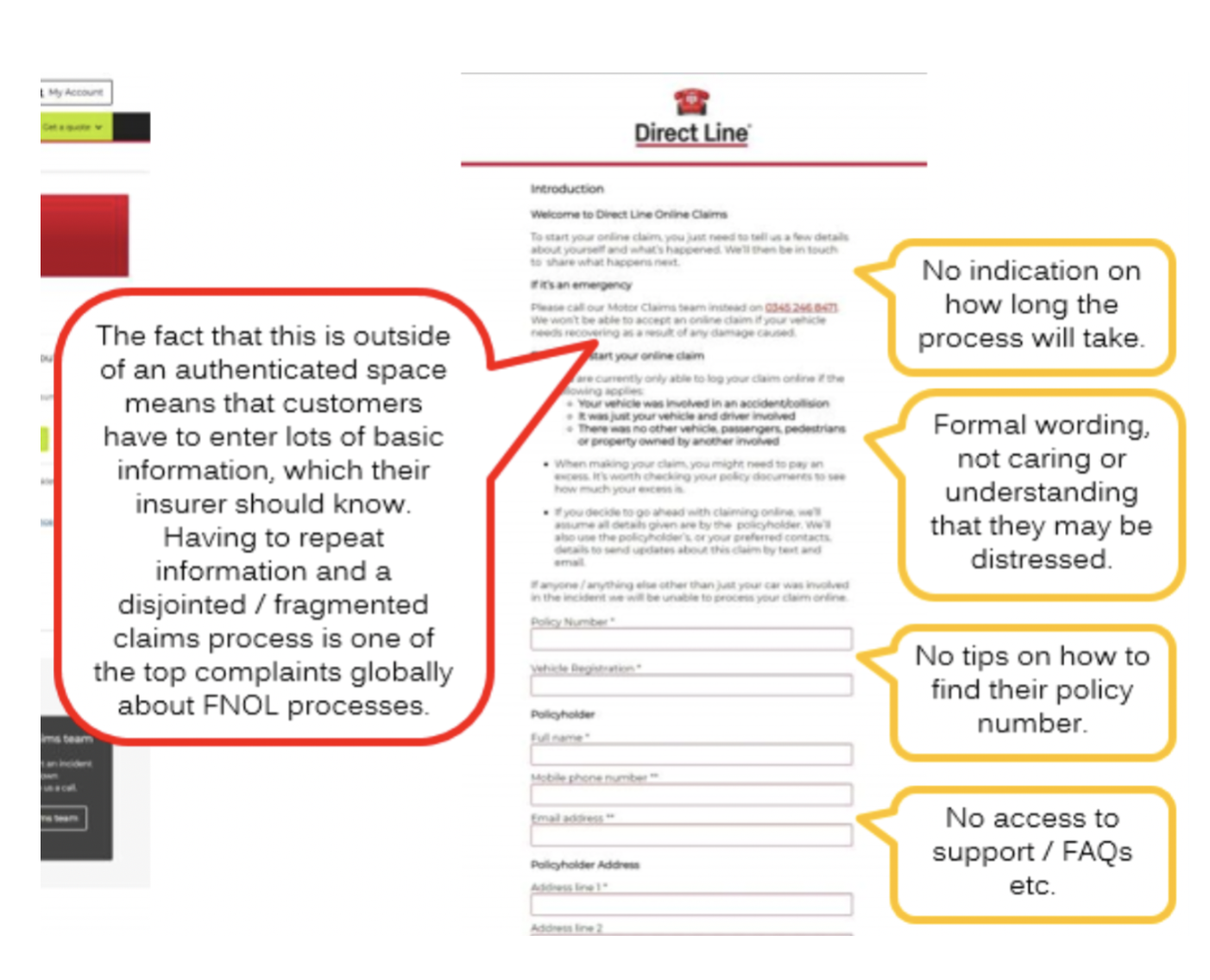

Although customers were able to complete the form, there were a few main issues:

Personalisation

Customers were frustrated that they had to re-enter information we already had.

Empathy

The process lacked reassuring and empathetic language.

Support

It was not clear to the customer where they could find certain information, such as their policy number.

Management of expectations

The form lacked information around how long the claim process would take or how far through the form the customer was.

-

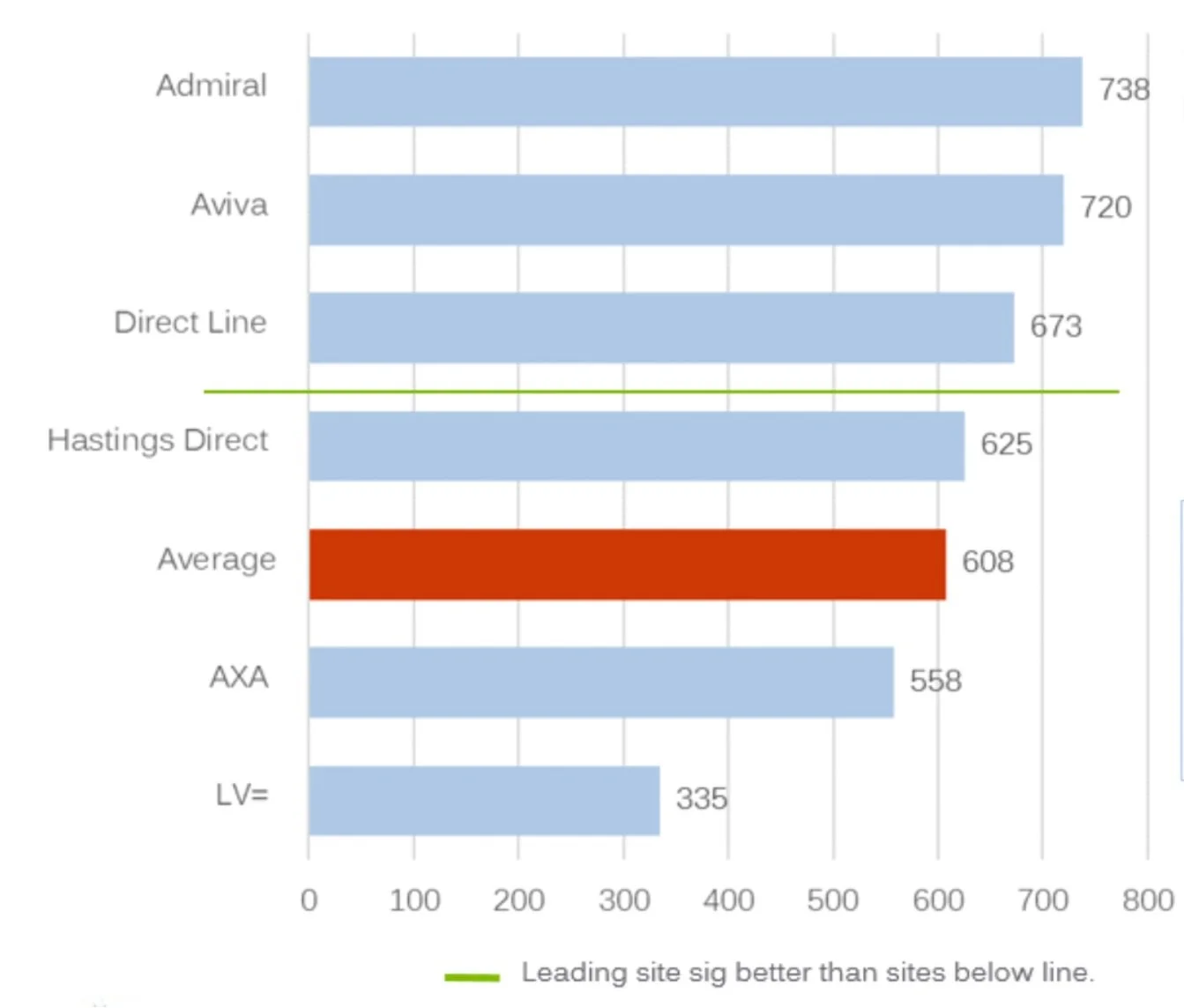

Through working with a leading global digital research consultancy, who had access to a large range of participants, it was possible to benchmark how we compared against our competitors and be able to see what was giving them a competitive advantage.

The metrics were based on 4 questions; How easy was it to start the process of making a claim? How easy was the claim to make? How much helpful was there about the claims process? How confident would you be about making a claim in the future?

Although we were above average, we were behind two of our leading competitors; Admiral and Aviva.

When looking specifically at claims, some of the biggest pain points identified in our claims journey vs. our competitors were that:

We asked for information, which customers did not have to hand, such as their policy number.

The customer had to re-enter information about themselves.

The navigation was unclear.

The form was too long.

-

It was important to understand who our customers were, the main things they were claiming for, their needs and what their experience was like when making a claim.

I reviewed the following information:

Customer demographics.

Survey feedback from the customer insights team.

Data on the most frequent claim types.

Recorded calls of customer claims using call miner software.

Discovery

Direct Line Group paid a third party provider to allow customers to submit their motor claims online. There were problems with this:

It was costly.

The information needed to be reentered into the claim systems.

Meet Peter

Using the information from the discovery work I conducted, I was able to create customer personas to represent our customers and their experiences. This helped to bring our customers to life and help put stakeholders in the shoes of our customers.

What problems were solved for the customer in the new claims journey?

-

When customers signed in to make a claim, we were able to pre-populate their policy information.

-

Understanding that the average reading age in the UK is 9-11 years old, we used clear and understandable language, offering reassurance to the customer.

-

Informed customers upfront how long the claim would take and what they would need.

Made customers aware what information they would need before starting their claim.

Progress displayed throughout claim.

Kept customers informed about what would happen after they submitted their claim.

-

Summary screens at the end of each section to give the customer the option to review information before submitting.

Confirmation screens to let the customer know the information has been saved.

-

Although I kept the journey simple with a one question one page approach, insights from the customer insight team told us that customers wanted to feel heard. As a result, it was important to give the customer additional free text boxes to explain what happened in their own words.

Visualising the end-to-end experience

It was important to understand how the end-to-end claims experience could look like for the customer. With the support of the business analysts, I was able to map out each part of the claims journey and understand how they would all fit together.

Understanding the entry points for the customer

Mapping out the end-end journey

A process

Once we had established this holistic view of the journey, I could then start to focus on specific sections and individual claim types, such as damage assessment.

Although not always a linear process, I tried to follow a flow to understand and create each part of the journey.

Damage assessment example

It was necessary to establish the extent of damage to the customer’s vehicle and whether it is repairable or a total loss. This was a large project, but this is an example of the process I used.

Listened to calls by to understand how customers described damage to their vehicles and how the call-handlers asked questions to find out what had happened.

Led workshops to understand from the business the information we needed to gather to make a decision on whether the vehicle was repairable.

Launched surveys using Userzoom at multiple stages during the process. This helped identify common language used to describe damage to vehicles. In addition, users commented that having both images and real-life comparisons would give them more confidence to determine which option was most relevant.

Stakeholder feedback I presented the findings back to stakeholders, who were able to support with prioritising obtaining images to include in the design.

Iteration Working closely with a copywriter we were able to use common language identified in user-testing. In addition, I was able to use images to help support the customer in determining the extent of the damage to their vehicle.

Improvement and optimisation Since going live, I have conducted additional usability testing uncovering additional insights, including:

Customers would find it easier if the images were taken from the same angle on the vehicle.

Customer would prefer to have multiple angles of the vehicle for each option.

Direct Line Group is also working with a third party supplier to look at digital damage assessment and calculation tools, which would further support the customer.

What’s the latest with the new online claims journey?

Since its launch, the new claims product has achieved:

97% customer accuracy rate in customers correctly reporting their claims

17-point increase in Customer Effort Score (CES)

22-point increase in Net Promoter Score (NPS)

94% of customers accepting who was at fault for the incident

92% conversion rate for customers using recommended garage to repair their vehicle.

As a result of its success, it is now being developed for Direct Line Group’s Privilege and Direct Line brands. Additionally, it helped secure a large contract with a key partner Motability, who have now adopted this claims form.

What customers are saying…

“The online forms were simple and intuitive and there were a lot of meaningful onscreen prompts and info.”

—Churchill customer

“Easy to follow instructions and it really walked me through the whole process from start to finish.”

— Churchill customer

Future Improvements

From both usability sessions and post-claim survey feedback, many customers have photographs and video evidence which they want to upload as part of their claim. At the moment, the journey does not have the functionality to do this. Photo and evidence submissions are currently on the enhancement list for the project.

At present, the application has a progress tracker, but it is limited in the information it provides to the customer. It currently only shows progress dots and does not inform the customer of the current section they are on. There is still work to do to optimise this progress tracker and provide more useful information to the customer.

Project challenges

A big challenge was the business constraints we were working within. Certain claim types necessitated asking specific questions to determine liability in incidents.

While these questions were crucial for business purposes, they often seemed unusual to customers. For instance, questions like "Did your car roll back?" were necessary to ascertain fault in rear-end collisions but could be confusing to the customer.

We made efforts to transparently explain the need for such information but achieving this required extensive collaboration with design, fraud prevention, and legal teams to find a solution that maintained this balance.