Revolutionising the Digital Claims Journey

Direct Line Group (DLG) owns some of the UK’s best-known brands including Direct Line, Churchill and Privilege.

We designed and built the UK’s first end-to-end digital motor claims form, redefining the claims process for these DLG brands.

The Problem

The existing online claims form was costly, inefficient, and frustrating for both customers and employees.

Key issues included:

A lack of personalisation or empathetic language used.

Long, unclear navigation resulting in poor user satisfaction.

Customer information had to be reentered into internal systems.

The Goal

Deliver a claims form that was fully integrated with our internal systems and which:

Provided the customer with an excellent end-to-end claims experience.

Offered an immediate decision on who was at fault for the incident.

Significantly reduce operational costs by replacing a third-party form.

My Role: Lead UX Designer

I contributed throughout the project lifecycle with responsibilities spanning:

Research

Ideation

Wireframing

Prototyping

Final UI Design

Research

Understanding the Claims Process

To understand the customer journey and identify pain points, I:

Held Q&A sessions with subject matter experts.

Reviewed data to understand the most frequent claim types.

Carried out call listening sessions to capture customer frustrations firsthand.

Visited technology centres and garages to gain insights into vehicle repairs.

Conducted usability tests on the existing claims form to identify a range of issues and areas for improvement.

Competitive Benchmarking

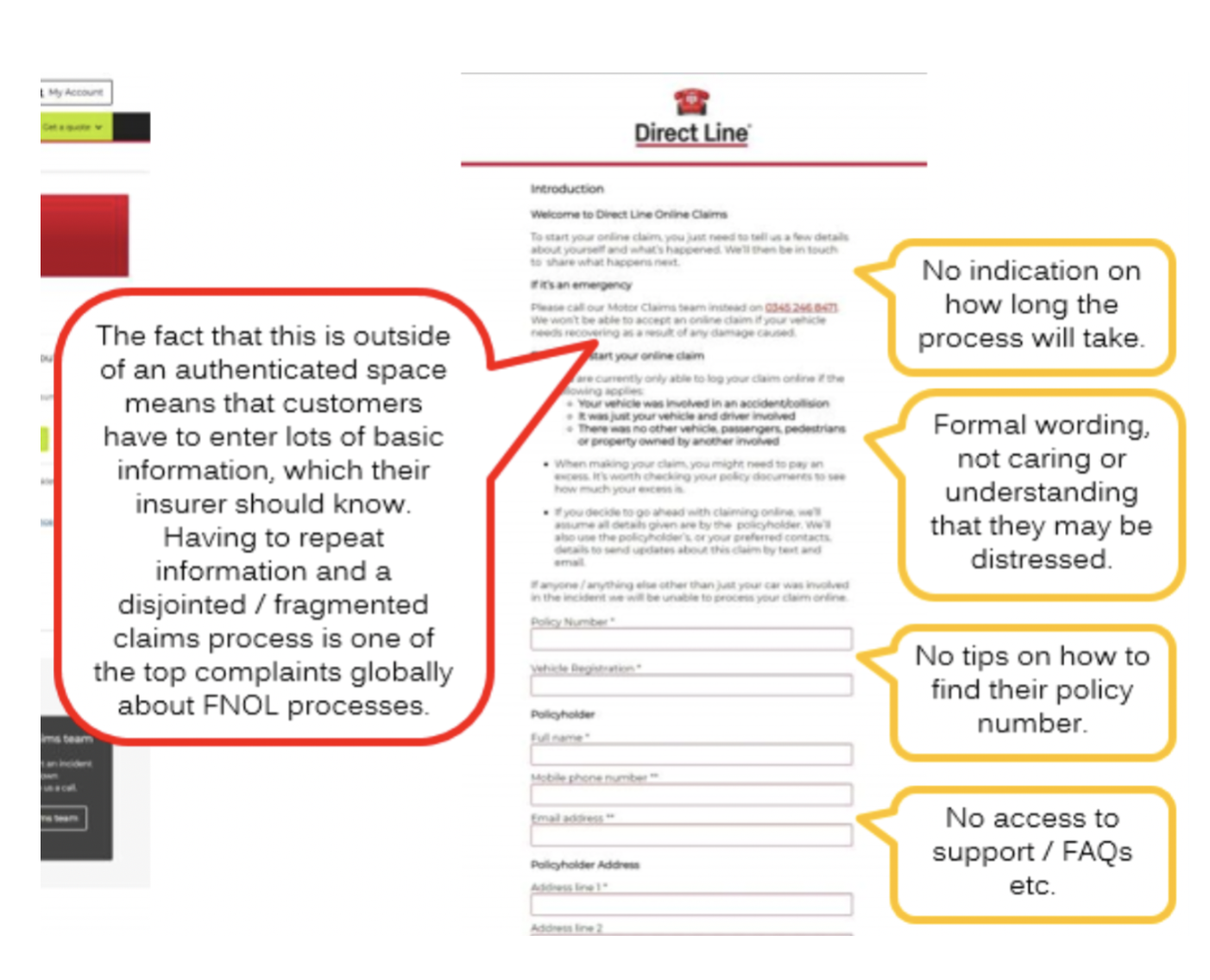

DLG lagged behind competitors. Pain points identified included:

Unclear navigation and repetitive questions.

Lengthy forms and lack of personalisation.

Lack of management of customer expectations.

Usability Testing

I conducted usability tests on the existing claims journey. Customer pain-points included:

Reassurance: Customers were unable to see a summary of the information they had entered.

Personalisation: Customers had to enter information they felt their insurer should already have about them.

A lack of empathy: The language used was lacking compassion towards the customer. In addition, customers felt the form contained insurance jargon.

Expectation Management: Customers wanted to know how long the form was going to take and how much progress they had made.

Customer Personas

I used demographics and customer feedback to create personas, like Peter, to help stakeholders understand and prioritise user needs.

Design Process

User-Flow Mapping

To create a seamless journey, I collaborated with business analysts to design user flows tailored to common claim types, starting with single-vehicle accidents. Iterative workshops with stakeholders ensured we captured all necessary information efficiently that would need to be incorporated into the journey.

Wireframing and Prototyping

Using wireframes, I tested early concepts through UserZoom, conducting surveys and usability testing to gather feedback and validate the design direction.

Damage Assessment Survey Example

In the damage assessment section of the claims journey, I launched multiple surveys to understand how the user would describe and categorise damage to cars.

Wireframe Example

I iterated on the designs based on research findings, ensuring they aligned with user needs and business goals. Following thorough testing and stakeholder feedback, I finalised the designs in Figma.

Finalised Designs in Figma

Accessibility and Design

Accessibility was a key focus throughout the design process. I conducted a comprehensive brand audit for Direct Line Group (DLG) to identify areas that didn’t comply with WCAG 2.1 standards in the Churchill, Direct Line, and Privilege brands.

I worked closely with the brand team and external accessibility specialists to implement changes, such as ensuring sufficient colour contrast for buttons and their interactive states.

These improvements not only made the claims journey more accessible but also laid the groundwork for ongoing efforts across DLG’s digital platform.

Addresssing the Pain-points

Customer insights directly influenced the design:

Reassurance: Offered confirmation screens and free-text boxes for customers to explain incidents in their own words.

Personalisation: Policy information was pre-populated for the customer.

Empathy: Used clear, reassuring language suitable for the UK’s average reading age (9-11).

Expectation Management: Added progress indicators, estimated form completion times, and summary screens.

Impact and Reflection

Outcomes

Since its launch, the new online claims journey has achieved:

97% accuracy rate in fault determination.

17-point increase in Customer Effort Score (CES).

22-point increase in Net Promoter Score (NPS).

94% of customers accepted fault decisions.

92% conversion rate for using recommended repair garages.

Additionally, this project secured a key contract with Motability, a UK-based company enabling people living with disabilities and their carers to lease vehicles, and was later expanded to other DLG brands.

Churchill customer Feedback

“It was really straight forward to complete. I felt like I was guided all the way through the process, so I knew what was happening at each stage”.

“I liked the way that it was split into sections, so I could concentrate just on one at the time, rather than trying to put all the information in at once. I was quite stressed when I started the form, but actually it was a really positive experience!”

Final Thoughts

This project highlights my ability to balance customer needs with business objectives, ensuring a seamless and scalable digital experience. Through a collaborative team effort, my team and I were able to:

Simplify a traditionally complex journey into an intuitive and user-friendly experience.

Deliver measurable impact, including significant increases in customer satisfaction and operational efficiency.

Build a scalable foundation that not only addressed current needs but also positioned DLG for future growth and adaptability.

Explore Other Projects

Driving Digital Adoption for Claims

Through strategic updates to the claims landing page, this project increased the number of customers initiating claims online -improving accessibility, boosting engagement, and driving digital adoption across DLG brands.

Empowering Customers to Manage their Claims Online

The Track and Manage hub, created for Motability and later adopted by Direct Line Group brands, transformed the post-claim experience by enabling customers to track progress, submit evidence, and access updates—all with ease and efficiency.